The CITC program offers a great incentive to give!

We have been awarded 2024 tax credits!

The CITC program provides an opportunity for individuals and businesses to:

PLEASE NOTE: As of July 22, 2024 we currently have $19,299.41 in tax credits available for 2024 on a first come first served basis. Contact us today!

What is the Community Investment Tax Credit Program?

The Community Investment Tax Credit program (CITC) is a program of the Maryland Department of Housing and Community Development that provides tax incentives to encourage Maryland individual residents and/or business entities to support qualified 501(c)(3) nonprofits - such as the Home Builders Care Foundation (HBCF) - that are working to improve our communities. Tax credits are awarded annually by the Maryland Department of Housing and Community Development on a competitive basis to 501c3 nonprofit organizations that sponsor community activities in Priority Funding Areas. Please see www.givemaryland.org for more information on the program.

How does the CITC work?

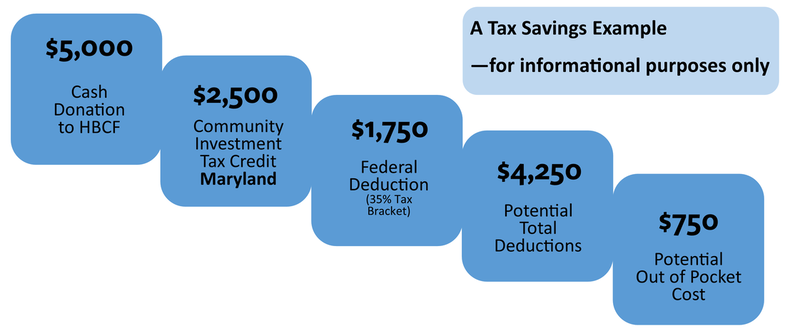

When you make a qualified donation of $500 or more to HBCF for our Shelter-Related Construction Assistance Program, you may be eligible to receive a Maryland CITC tax credit equal to half the value of your donation if tax credits are available. CITC tax credits are equal to 50% of the value of the donated money, goods or real property and are IN ADDITION to Federal and State charitable tax deductions as a result of the contribution.

We have been awarded 2024 tax credits!

The CITC program provides an opportunity for individuals and businesses to:

- reduce their Maryland tax liability

- help this local nonprofit organization achieve our essential community goals, and

- make a targeted impact on their community by having a direct say as to where your tax dollars are spent.

PLEASE NOTE: As of July 22, 2024 we currently have $19,299.41 in tax credits available for 2024 on a first come first served basis. Contact us today!

What is the Community Investment Tax Credit Program?

The Community Investment Tax Credit program (CITC) is a program of the Maryland Department of Housing and Community Development that provides tax incentives to encourage Maryland individual residents and/or business entities to support qualified 501(c)(3) nonprofits - such as the Home Builders Care Foundation (HBCF) - that are working to improve our communities. Tax credits are awarded annually by the Maryland Department of Housing and Community Development on a competitive basis to 501c3 nonprofit organizations that sponsor community activities in Priority Funding Areas. Please see www.givemaryland.org for more information on the program.

How does the CITC work?

When you make a qualified donation of $500 or more to HBCF for our Shelter-Related Construction Assistance Program, you may be eligible to receive a Maryland CITC tax credit equal to half the value of your donation if tax credits are available. CITC tax credits are equal to 50% of the value of the donated money, goods or real property and are IN ADDITION to Federal and State charitable tax deductions as a result of the contribution.

Individuals and businesses contemplating a donation are encouraged to consult with their tax professional for information about their specific tax benefits, based on their situation.

Please note that in order for HBCF to qualify your gift for the CITC program:

- your gift must be at least $500. State tax credits begin at $250 (50%)

- HBCF must have tax credits available.

- the donor tax ID number (i.e. personal SNN or business EIN) on the checking or credit card account used - MUST match the Maryland taxpayer account to receive the credit.

- If you are ready to go contact us TODAY to confirm our tax credit availability. 301-776-6212 or email [email protected]

- Then - FOLLOW THIS LINK TO OUR CITC DONATION PAGE

Individuals and businesses must start using state tax credits against taxes owed for the year in which the contribution is made.

Any excess credits may be carried over for 5 years following the tax year in which the contribution was made.

Credits may not be used retroactively.

Please contact Patti Kane, HBCF Director 301-776-6212 with any immediate questions OR to begin the process. We must confirm that tax credits are available. Thanks!

After completing your donation, HBCF will certify your contribution with the State of Maryland, who will then provide final official tax credit paperwork needed to accompany your state tax return.

Any excess credits may be carried over for 5 years following the tax year in which the contribution was made.

Credits may not be used retroactively.

Please contact Patti Kane, HBCF Director 301-776-6212 with any immediate questions OR to begin the process. We must confirm that tax credits are available. Thanks!

After completing your donation, HBCF will certify your contribution with the State of Maryland, who will then provide final official tax credit paperwork needed to accompany your state tax return.